child tax credit 2021 dates by mail

Mail Form 8822 to the IRS Service Center or US. The 2021 advance monthly child tax credit payments started automatically in July.

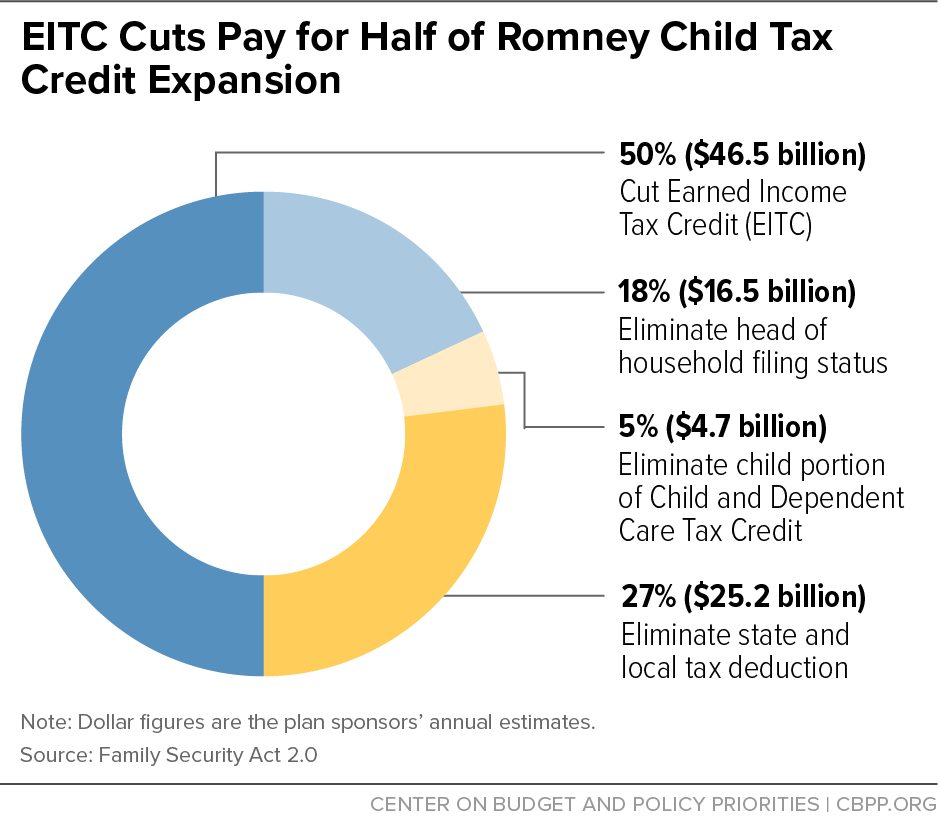

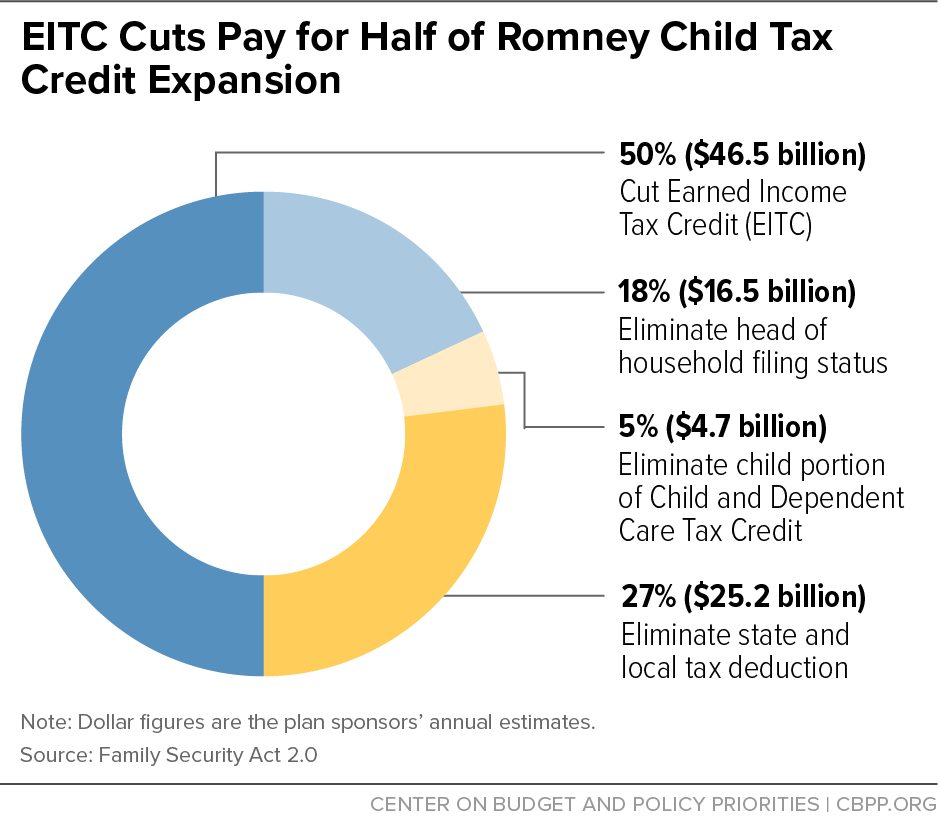

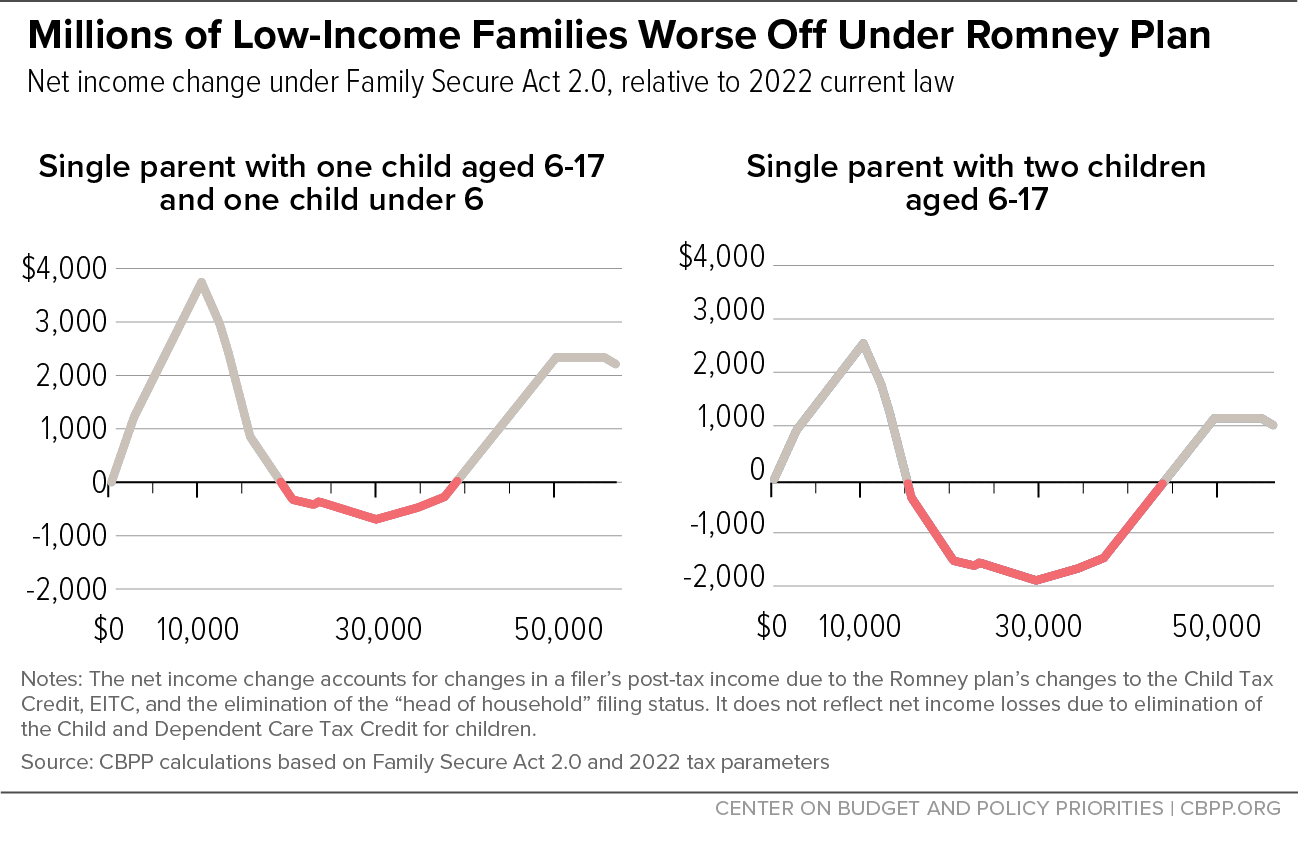

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

The My Revenue portal will no longer be available after July 23 2021.

. CCBYCS was paid separately from CCB with the payment dates on. He was Member of the European Parliament MEP for South East England from 1999 until the United Kingdoms. He has been featured or quoted in The Globe and Mail Winnipeg Free Press Wealthsimple Financial Post Toronto.

Estimated tax payments are due on or before the 15 th day of the 6 th and 9 th and 12 th month of the fiscal year. 2022 IRS tax deadline postmark deadline for 2021 tax return filing tax season start date estimated payment deadlines where to e-file. Nigel Paul Farage ˈ f ær ɑː ʒ.

In addition 500 was paid for each qualifying child for the first EIP 600 for the second and 1400 for the third. Dont think that the child tax credit payments going out in just over two weeks are all the IRS is focused on. Heres what you need to know.

EITC or the Additional Child Tax Credit until. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of August as direct deposits begin posting in bank accounts and checks arrive in mailboxes. Search for a department and find out what the government is doing.

A service members dependent such as an unmarried child under the age of 18 an unmarried child and full-time student between ages 18 to 23 or others for whom the service member provided at least 50 of their support for 180 days before the date of the application. Where more than one foreign tax redetermination requires a redetermination of US. Your 2021 tax return is used to determine your eligibility for OCB payments from July 2022 to June 2023.

The Fair Credit Reporting Acts FCRA Section 611 allows. The current tax season has been as bumpy as the last with many tax filers reporting delayed refund payments due to IRS processing backlogs and reconciliation of catch-up payments for stimulus checks RRC and advance child tax credit payments. Department of Revenue forms will be made available on MTRevenuegov.

You may be eligible for a subsidy to cover part of your commercial rent or property expenses between October 24 2021 and May 7 2022. Instead it refers to the date that the tax return is postmarked. Born 3 April 1964 is a British broadcaster and former politician who was Leader of the UK Independence Party UKIP from 2006 to 2009 and 2010 to 2016 and Leader of the Brexit Party renamed Reform UK in 2021 from 2019 to 2021.

Advance child tax credit payments. Depending on the period you are applying for you may be eligible to claim your commercial rent or property expenses through one of the following. If the corporation wants to allow the FTB to discuss its 2021 tax return with the paid preparer who signed it check the Yes box in the signature area of the.

IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in. Mail Franchise Tax Board PO Box 942857 Sacramento CA 94257-0500. Call the automated refund hotline at 800-829.

This blog post is for the people who cannot afford my paid credit repair services in Los Angeles and prefer a self help strategy. People who dont use direct deposit will receive their payment by mail around the same time. 17 2022 you can no longer e-File IRS or state income taxes for Tax Year 2021.

From July through December 2021 advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. The IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per. The IRS cant issue refunds before mid-February 2021 for returns that claimed the EIC or the additional child tax credit ACTC.

Learn about the Ontario Child Benefit including payment dates and amounts in 2022 Ontarios child tax credit and child-related benefits through Ontario Works. The tax agency continues to send weekly batches of the third stimulus checks with. See instructions on how to prepare.

The advance child tax credit payments were early payments of up to 50 of the estimated child tax credit that taxpayers may properly claim on their 2021 returns. Download the official IRS2Go app to your mobile device to check your refund status. The amount of the tax credit will be based on the number of hours the employee works in the taxable year.

You can learn more on the Debt Relief for Military Service Members page. Territory tax administration address designated for your old address see page 2 of Form 8822If you. The advance child tax credit payments were early payments of up to 50 of the estimated child tax credit that taxpayers may properly claim on their 2021 returns.

IR-2021-169 August 13 2021. The timely tax deadline to pay and e-File 2021 Taxes is April 18 2022If you miss this date you have until October 15 October 17 2022Keep in mind if you owe taxes and dont file a tax extension you might be subject to tax penalties. Tax liability for the same tax year and those redeterminations occur in the same tax year or within 2 consecutive tax years you can file for that tax year one notification Form 1040-X with a Form 1116 and the required statement that reflects all those tax.

The contractor shall mail or deliver the NOA to the parents at least 14 calendar days before the effective date of the intended action. So Ive distilled my 20 years of experience of fixing credit scores into an advanced method credit bureau dispute letter with specific instructions on how to utilize it. If you have records currently saved in My Revenue we ask you to log into your My Revenue account and download them before July 23 2021.

The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official start. Use Form 8822 to notify the IRS and US. If the NOA is mailed the 14 calendar day period is extended by 5.

The names gender and birth dates of all children under the age of eighteen in the family whether or not they are served by the program. Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. Territory tax administration if appropriate.

Log into My Revenue. May 28 2021 includes January and April payments July 30 2021. For S corporations required to make estimated tax payments on behalf of their nonresident shareholders such estimated tax payments are due on or before April 15 June 15 and September 15 of 2021 and January 18 of 2022.

From July through December 2021 advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. If your child is eligible for the disability tax credit DTC and Canada Child Benefit they. This applies to the entire refund not just the portion associated with these credits.

So if you mail out your tax return on April 18 by USPS mail and the IRS receives. Under the American Rescue Plan Act of 2021 the ARP the child tax credit has been enhanced for 2021. Advance child tax credit payments.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

2021 Child Tax Credit Advanced Payment Option Tas

Despite Flaws Romney Proposal On Child Tax Credit Creates Opening For Bipartisan Action Center On Budget And Policy Priorities

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979603/GettyImages_1358862218a.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Child Tax Credit Payments Will Start In July The New York Times

Always Keep Employee Td1 S Up To Date Tax Credits Hiring Employees New Bus

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr